As Americans, we celebrated Independence Day this month flocking to places like Mount Vernon, Monticello and Peacefield to learn and understand more about our country's history and the men and women who shaped its future. The homes of founding fathers like George Washington, Thomas Jefferson and John Adams were more than shelter; they were places of respite, reflection and inspiration.

"Homeownership is an investment in our future, but it's also a gateway to our past," said National Association of Realtors President Moe Veissi, broker-owner of Veissi & Associates Inc., in Miami. "The homes of our country's founders offer insights into their characters and values, and reflect the spirits of their owners, just as our homes do for us today."

"Homeownership is an investment in our future, but it's also a gateway to our past," said National Association of Realtors President Moe Veissi, broker-owner of Veissi & Associates Inc., in Miami. "The homes of our country's founders offer insights into their characters and values, and reflect the spirits of their owners, just as our homes do for us today."

In some ways, historic homeowners bear little resemblance to the homeowners of today. George Washington inherited Mount Vernon when he was 20; only 4 percent of recent home buyers were between the ages of 18-24, according to the 2011 NAR Profile of Home Buyers and Sellers. John Adams was born in the house that would remain in the Adams family for four generations. Today, fewer than 3 percent of families in this country have received their primary residence as an inheritance, according to a recent Survey of Consumer Finances published by the Federal Reserve Board.

Women's rights to own property in America's early days were often based on their relationships with men, so it's not surprising that many women today view homeownership as its own form of independence, with single women representing more than one-fifth of all home buyers in the current market.

Homeowners across U.S. history do share some common ground, of course. Most of the founding families lived out their lives close to where they were born, and the same is true today. The U.S. Census Bureau reports that nearly 60 percent of Americans currently live in the state in which they were born, and NAR research shows that the typical buyer moves only 12 miles from his or her previous residence.

"I am as happy nowhere else and in no other society, and all my wishes end, where I hope my days will end, at Monticello," said Thomas Jefferson of his home. Although today's economic environment has postponed homeownership for some, numerous surveys show that most Americans still aspire to homeownership. In the NAR Profile, a full 60 percent of recent first-time home buyers cited the desire to own a home of their own as the primary reason for purchasing a home.

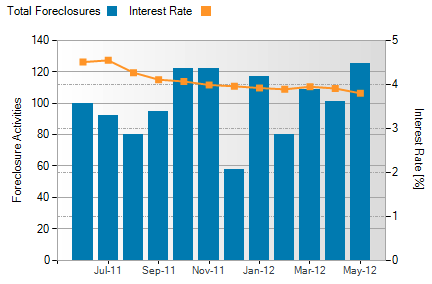

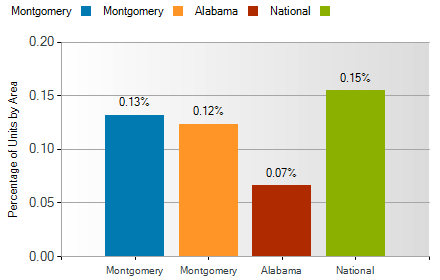

Lets look at the June statistics in our local real estate market?

Midtown Montgomery real estate sales statistics for June show the number of homes sold remained consistent when compared to May 2011. The average sales price decreased by 25% to $113,872 during the same period. The median sales prices decreased by 39%, and market times decreased by 15% or 19 days. The highest selling home price decreased by 1%, and the lowest selling home price decreased by 38%.

|

Midtown Montgomery |

June 2012 |

June 2011 |

|

Homes Sold |

32 |

32 |

|

Average Selling Price |

$ 113,872 |

$ 151,399 |

|

Median Selling Price |

$ 80,250 |

$ 132,000 |

|

Days On The Market |

111 |

130 |

|

Highest Selling Price |

$ 415,000 |

$ 417,500 |

|

Lowest Selling Price |

$ 10,000 |

$16,000 |

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

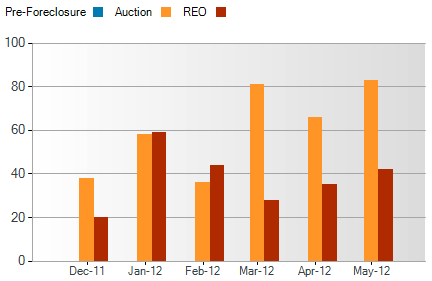

Interested in buying a bank-owned home? Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

Information is provided by the Montgomery Area Association of Realtors and is deemed accurate but not guaranteed.

The London Summer Olympic Games begin tomorrow and end Sunday, August 12, 2012, and will highlight 302 events in 26 sports ranging from archery to wrestling.

The London Summer Olympic Games begin tomorrow and end Sunday, August 12, 2012, and will highlight 302 events in 26 sports ranging from archery to wrestling.  "Homeownership is an investment in our future, but it's also a gateway to our past," said National Association of Realtors President Moe Veissi, broker-owner of Veissi & Associates Inc., in Miami. "The homes of our country's founders offer insights into their characters and values, and reflect the spirits of their owners, just as our homes do for us today."

"Homeownership is an investment in our future, but it's also a gateway to our past," said National Association of Realtors President Moe Veissi, broker-owner of Veissi & Associates Inc., in Miami. "The homes of our country's founders offer insights into their characters and values, and reflect the spirits of their owners, just as our homes do for us today." Reduce the heat inside your

Reduce the heat inside your .jpg) Before you even begin your physical efforts, you should explore popular new trends in bathroom function, among which are wall-mounted toilets, recessed tubs, offbeat sinks, heated towel racks, and the use of stone. A tour of model homes in your area will give you a good idea of what’s “hot” and what you might like to include in your own bathroom. Websites such as

Before you even begin your physical efforts, you should explore popular new trends in bathroom function, among which are wall-mounted toilets, recessed tubs, offbeat sinks, heated towel racks, and the use of stone. A tour of model homes in your area will give you a good idea of what’s “hot” and what you might like to include in your own bathroom. Websites such as

.jpg)