Thursday, February 26, 2015

by The Hat Team

Is your credit score a big deal? If you want to buy a home, it’s a huge deal!

Your credit score will determine if you can get a loan. It will also determine how much you can borrow and what your interest rate will be! To buy a home with a mortgage loan you must have a strong credit score.

There are three primary sources for credit scores in the US: Equifax, Experian and TransUnion. They all use the FICO system. These are the most used sources by creditors.

There are three primary sources for credit scores in the US: Equifax, Experian and TransUnion. They all use the FICO system. These are the most used sources by creditors.

FICO developed the computer software the major credit scoring companies use. FICO scores range from 300 to 850. However, many creditors consider 500 to be the bottom of the acceptable range.

Your score is a measure of your credit-worthiness and determines the interest rate that you will pay for a loan. It’s not unusual for a creditor to obtain all three of the major scores and average them. A very good score is 700, and an excellent score in 750.

The primary factors that determine your score are:

- payment history (35%)

- debt/amounts owed (30%)

- age of credit history (15%)

- new credit/inquiries (10%)

- mix of accounts/types of credit (10%)

65% of the total score is determined by only two factors: payment history and amount of debt owed. You must have a good history of paying your bills on time. And you must be very careful about how much debt you have relative to your income!

That last point is extremely important when borrowing for a home mortgage. As of 2014 the federal regulations governing mortgage lending have changed. Borrowers can no longer carry total debt of more than 43% of gross annual income, including the mortgage debt! Lenders are going to be very strict about adhering to that ratio. There are serious consequences for the lender not doing so.

Many actions you take affect your score. Most people don’t think about:

- unpaid medical bills and parking tickets can lower your credit score

- heavy credit use can lower your score, even if you pay large balances off in full in a short time

- credit scores drop if you sign up and use store cards for initial discounts

For more advice about managing your credit, click here.

Looking forward to buying a home? Educate yourself, manage your credit score, and know your credit score before your lender does.

Information courtesy of Montgomery AL Real Estate Experts Sandra Nickel Hat Team REALTORS!

.jpg)

There are three primary sources for credit scores in the US:

There are three primary sources for credit scores in the US:

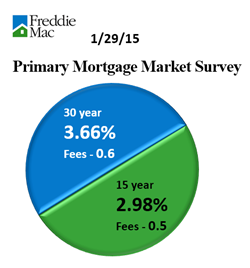

While the borrower and the property affect the rate and terms that a lender may offer, it is not to be said that all lenders will offer the same terms and rates to the same buyer. Credit score, home location, home price and loan amount, down payment, loan term, interest rate type and loan type all affect the interest rate but different lenders can interpret this information differently.

While the borrower and the property affect the rate and terms that a lender may offer, it is not to be said that all lenders will offer the same terms and rates to the same buyer. Credit score, home location, home price and loan amount, down payment, loan term, interest rate type and loan type all affect the interest rate but different lenders can interpret this information differently..jpg)

.jpg)

.jpg)