Will You Owe Capital Gains When Selling Your Montgomery Home

Something to consider when selling your home is the Capital Gains ramifications. Will you owe Uncle Sam money after the sale of your Montgomery home? Capital Gains are calculated as the difference between what you paid for your property and what you sell it for. Here is how you calculate your Capital Gains.

Calculating Capital Gains

(+) PURCHASE PRICE - Price paid for property

(+) COST OF PURCHASE - Transfer fees, attorney fees, inspections

(+) COST OF SALE - Repairs, commissions, attorney fees, inspections

(+) COST OF IMPROVEMENT - Room additions, deck, for example, though not replacing existing

(=) ADJUSTED COST BASIS OF YOUR HOME

(-) AMOUNT YOU SELL YOUR HOME

(=) CAPITAL GAIN

A Special Real Estate Exemption for Capital Gains

Even though the above calculation may indicate you owe Capital Gains, there is a special real estate exemption. Since 1997, up to $250,000 in capital gains ($500,000 for a married couple) on the sale of a Montgomery home is exempt from taxation if you meet the following criteria:

- You have lived in the home as your principal residence for two out of the last five years.

- You have not sold or exchanged another home during the two years preceding the sale.

NOTE: As of 2003, you may also qualify for this exemption if you meet what the IRS calls "unforeseen circumstances" such as job loss, divorce, or family medical emergency.

Learn more about selling your Montgomery home by visiting HatTeam.com.

What's your Montgomery home worth?

Always consult a tax attorney regarding current tax laws.

Myth: Checking a credit report can either damage or lower your score.

Myth: Checking a credit report can either damage or lower your score.

wonder or worry about selling their home for the best price, and terms in the shortest period of time.

wonder or worry about selling their home for the best price, and terms in the shortest period of time.  Tax Credit for First-Time Home buyers

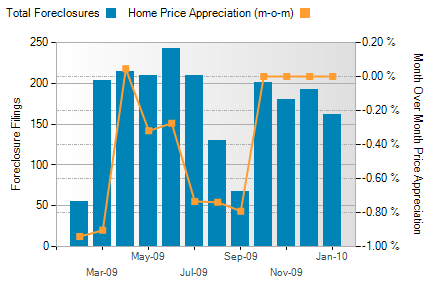

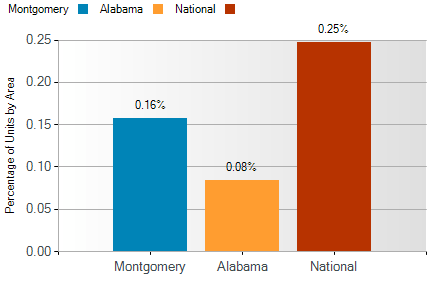

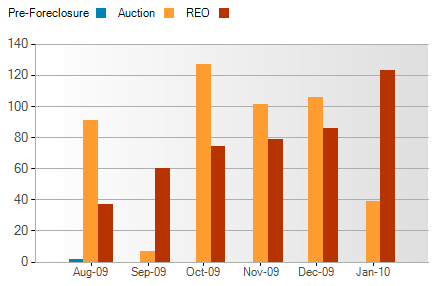

Tax Credit for First-Time Home buyers  This month's edition covers Montgomery real estate market activity and then we'll offer three top tips to make sure you get the most of today’s opportunity!

This month's edition covers Montgomery real estate market activity and then we'll offer three top tips to make sure you get the most of today’s opportunity!