Real Estate Projects That Pay Off

As the spring “spruce up” season approaches, the fancy of Montgomery AL real estate owners often turns to home improvement projects. Whether these be large or small, interior or exterior, for resale purposes or for personal  enjoyment, do-it-yourself or contracted out, nearly 30 % of renovators maintain that they are hoping to increase the value of their home and recoup as much of the cost as they can.

enjoyment, do-it-yourself or contracted out, nearly 30 % of renovators maintain that they are hoping to increase the value of their home and recoup as much of the cost as they can.

Taking precedence would be the non-glamorous “basic updates” to maintain a healthy, solid, safe home To that end, deal with repainting, fixing the leaky roof, and replacing rotting wood, wiring, and/or plumbing as needed are ongoing needs.

And then?

- One of the top remodeling projects is as simple as replacing the siding on the outside of your home, thus increasing both protection and curb appeal to your Montgomery AL real estate. Choose either fiber-cement to recoup 78% of the cost or vinyl for a payback of 69.5 %.

- Updating your windows comes next. Whether you select vinyl or wood windows to replace drafty old ones, you can recoup up to 69.1 percent of the project's cost on your home's resale value. New windows do much for the look of a home inside and out and certainly contribute to energy-efficiency.

- Since kitchens have become increasing important facets of Montgomery AL real estate, remodeling updates in this room pay off and are well-worth considering. According to HGTV, you can expect to recoup 60%-120% of your investment on a kitchen remodel, as long as you don’t go overboard. You should never make your kitchen fancier than the rest of the house--or the neighborhood, for that matter.

- And don’t forget energy-efficiency in the kitchen improvement plans. . By using energy-efficient appliances, households can save up to $400 per year on utility bills. Click here for a few simple steps to follow when shopping for energy-efficient appliances.

- The National Association of Home Builders states that adding a bathroom to a single-family detached home has a strong impact on the home's overall value. An additional bathroom, even a half bathroom, adds significant value to your home, according to the experts at NAHB. A half bath may add up to 10.5 percent to a home’s value, while a full bath can tack on an additional 20 percent.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home? Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

Originally, in 1913 with the Sixteenth Amendment, Income Tax allowed a deduction on any interest paid by a taxpayer. Prior to World War I, most interest was paid for business purposes and very little paid by individuals. Credit cards, revolving credit, student loans and home equity loans that would charge interest would not become popular for decades.

Originally, in 1913 with the Sixteenth Amendment, Income Tax allowed a deduction on any interest paid by a taxpayer. Prior to World War I, most interest was paid for business purposes and very little paid by individuals. Credit cards, revolving credit, student loans and home equity loans that would charge interest would not become popular for decades.

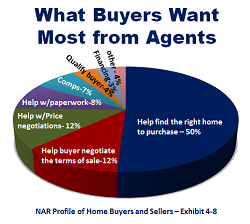

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise.

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise. Another important checkup that should be done on a regular basis and can be just as beneficial for your finances is an annual homeowner advisory. Why would you treat your investment in your home with less care than you treat your car or even your HVAC system?

Another important checkup that should be done on a regular basis and can be just as beneficial for your finances is an annual homeowner advisory. Why would you treat your investment in your home with less care than you treat your car or even your HVAC system? It isn’t difficult to get into the real estate investing world. In fact, it’s rather easy. But it does require being smart and dedicated—and avoiding easy-to-make mistakes. These tips for a first time real estate investor should be beneficial in helping you become more knowledgeable and competent in sidestepping common pitfalls.

It isn’t difficult to get into the real estate investing world. In fact, it’s rather easy. But it does require being smart and dedicated—and avoiding easy-to-make mistakes. These tips for a first time real estate investor should be beneficial in helping you become more knowledgeable and competent in sidestepping common pitfalls.