Midtown Montgomery Real Estate Market Trends - March 2012

The increases in FHA mortgage guarantee costs that took effect on April 1 have many home buyers asking, "What do these increases mean to me when I get an FHA loan?" Megan Booth and Rob Freedman with Realtor.tv break down the facts in this informative video.

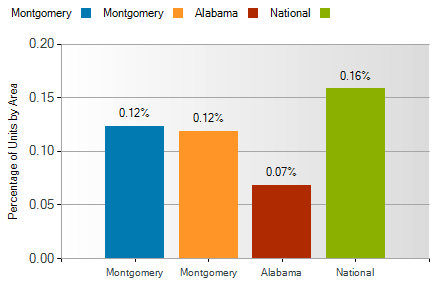

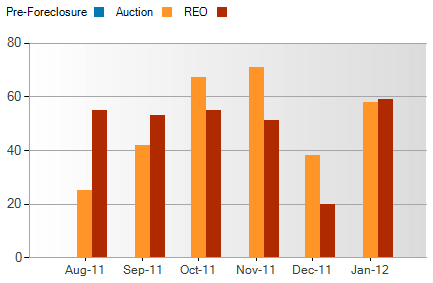

Lets look at the statistics in our local real estate market?

Midtown Montgomery real estate sales statistics for March show the average sales price decreased by 26% to $95,339 when compared to March 2011. The number of homes sold increased by 33% in March 2012. The median sales prices decreased by 51%, and market times increased by 8% or 11 days. The highest selling home price increased by 7%, and the lowest selling home price increased by 67%.

| Midtown Montgomery | March 2012 | March 2011 |

| Homes Sold | 33 | 22 |

| Average Selling Price | $ 95,339 | $ 128,461 |

| Median Selling Price | $ 55,000 | $ 112,000 |

| Days On The Market | 133 | 122 |

| Highest Selling Price | $ 375,000 | $ 350,000 |

| Lowest Selling Price | $ 13,500 | $4,500 |

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

You can reach Sandra by filling out the online contact form below or give her a call anytime.

Information is provided by the Montgomery Area Association of Realtors and is deemed accurate but not guaranteed.

Unfortunately, rumors and myths abound about the difficulty or even impossibility of cancelling refundable mortgage insurance. Fortunately, however, the Homeowner’s Protection Act of 1998 requires lenders of insurance loans for

Unfortunately, rumors and myths abound about the difficulty or even impossibility of cancelling refundable mortgage insurance. Fortunately, however, the Homeowner’s Protection Act of 1998 requires lenders of insurance loans for

Unfortunately,

Unfortunately,  TERMS:

TERMS: Although a divorce eventually involves the distribution of all of a couple’s assets—and action dictated by either an equitable distribution system or community property regulation—generally the most pressing issue (other than child custody)—is the resolution of dividing your

Although a divorce eventually involves the distribution of all of a couple’s assets—and action dictated by either an equitable distribution system or community property regulation—generally the most pressing issue (other than child custody)—is the resolution of dividing your