The news lately has been filled with reports of tornadoes, hurricanes, floods, and fires, each of which has resulted in untold loss of lives, homes, and possessions. As we watch with horror the impact these disasters have on those  affected, it is only natural that we ask ourselves,” Would I be able to sustain such losses? Would my homeowners insurance policy cover the costs of rebuilding my home?

affected, it is only natural that we ask ourselves,” Would I be able to sustain such losses? Would my homeowners insurance policy cover the costs of rebuilding my home?

The National Association of Insurance Commissioners (NAIC)) recommends that you use your annual renewal notice or any improvements to your home as a reminder to touch base with your agent or insurer to recheck how much insurance you really need. Do you have sufficient coverage for rebuilding and replacement? Amy Bach, executive director of United Policyholders, a consumer advocacy group, urges homeowners not to blindly trust that their home insurer has all the bases covered.

With fluctuations in the real estate market, coverage equal to the current replacement cost (excluding land), is advisable. The first step in getting adequate coverage is to establish your policy’s dwelling limit. Your target number is the full-replacement cost of your home and its possessions. The dwelling limit bears no relation to your property’s market value, its appraised value, or its assessed tax value. And don’t mistake the cost of new construction for the cost to rebuild, which is more expensive because of factors such as debris removal and higher demand for materials and labor after a catastrophe,

(You can get a pretty good idea of what it would cost to rebuild your home by using an online calculator, available at sites such as HMFacts.com ($7) and AccuCoverage.com ($8).

It’s a good idea to purchase guaranteed replacement coverage, meaning the insurer will pay whatever it costs to rebuild your home with materials of like kind and quality, without deducting for wear and tear. Avoid actual cash value coverage, which pays only the depreciated value of your home.

Check also on your need for flood insurance, even if you don’t live near a body of water, since policies vary in their coverage of many types of water damage.

And lastly, it goes without saying that you need to update the inventory of your possessions at least annually since it is not only a record of the contents of your house and their value, but also a good indicator of whether you have enough coverage.

Information courtesy of Montgomery AL Realtor Sandra Nickel, Sandra Nickel Hat Team.

It is possible to adjust the deductions being withheld from the homeowner’s salary so they realize the benefit of the savings prior to filing their tax returns in the form of more money in their pay checks. Employees would talk to their employers about increasing their deductions stated on their W-4 form.

It is possible to adjust the deductions being withheld from the homeowner’s salary so they realize the benefit of the savings prior to filing their tax returns in the form of more money in their pay checks. Employees would talk to their employers about increasing their deductions stated on their W-4 form. Actually, no. Unfortunately, there are clever identity thieves waiting at that end of your relocation, also, and your

Actually, no. Unfortunately, there are clever identity thieves waiting at that end of your relocation, also, and your  Single family homes for rental purposes offer an excellent rate of return in an investment that most people understand better than other investments. The concept is simple: stay with predominantly owner-occupied homes in a slightly below average price range. In most areas, tenants are easy to find and they’ll usually stay two to three years or more.

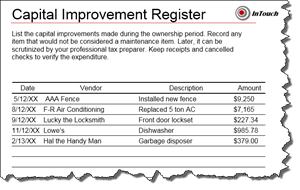

Single family homes for rental purposes offer an excellent rate of return in an investment that most people understand better than other investments. The concept is simple: stay with predominantly owner-occupied homes in a slightly below average price range. In most areas, tenants are easy to find and they’ll usually stay two to three years or more. Improvements must add value to your home, prolong its useful life or adapt it to new uses. Repairs are routine in nature to maintain the value and keep the property in an ordinary, operating condition.

Improvements must add value to your home, prolong its useful life or adapt it to new uses. Repairs are routine in nature to maintain the value and keep the property in an ordinary, operating condition..jpg)

information behind that others can use---mail that is not rerouted to our new address, important papers that aren't shredded but left in the trash, or through hiring rogue movers. The

information behind that others can use---mail that is not rerouted to our new address, important papers that aren't shredded but left in the trash, or through hiring rogue movers. The  affected, it is only natural that we ask ourselves,” Would I be able to sustain such losses? Would my homeowners insurance policy cover the costs of rebuilding my home?

affected, it is only natural that we ask ourselves,” Would I be able to sustain such losses? Would my homeowners insurance policy cover the costs of rebuilding my home?