Montgomery AL Foreclosure Trends - July 2013

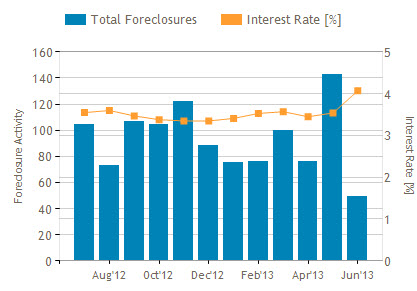

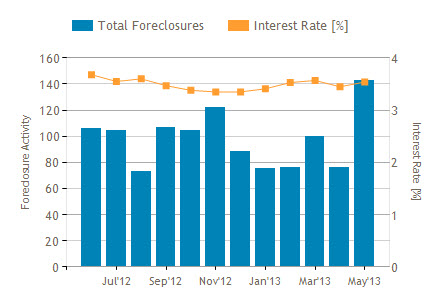

In July, the number of properties that received a foreclosure filing in Montgomery, AL was 96% higher than the previous month and 8% lower than the same time last year, according to RealtyTrac.com.

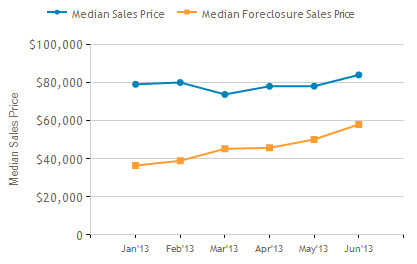

Montgomery AL Foreclosure Discount

The median sales price of foreclosed homes is $25,991 less than regular homes.

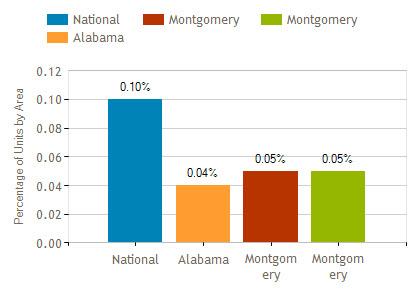

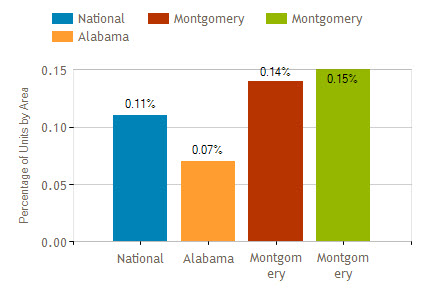

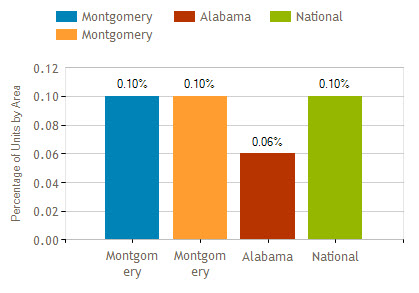

Montgomery AL Foreclosure Geographical Comparison

Montgomery AL foreclosure activity was the same as national statistics, 0.04% higher than Alabama and the same as Montgomery County statistics in July 2013.

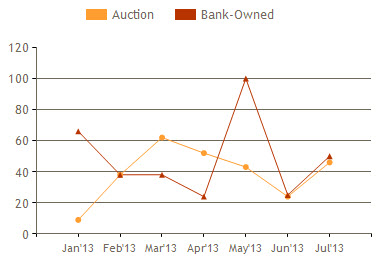

Montgomery AL Foreclosure Activity by Month

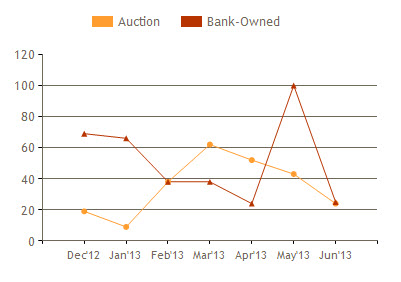

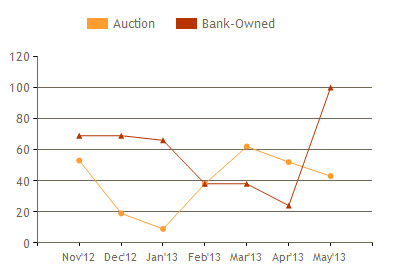

The number of Bank-Owned properties increased 100.0% compared to June and dropped 24.2% compared to July 2012. The number of Auctions increased 91.7% compared to June and decreased 21.1% from July 2012.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home. Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

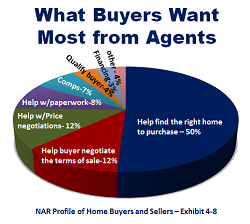

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise.

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise. It isn’t difficult to get into the real estate investing world. In fact, it’s rather easy. But it does require being smart and dedicated—and avoiding easy-to-make mistakes. These tips for a first time real estate investor should be beneficial in helping you become more knowledgeable and competent in sidestepping common pitfalls.

It isn’t difficult to get into the real estate investing world. In fact, it’s rather easy. But it does require being smart and dedicated—and avoiding easy-to-make mistakes. These tips for a first time real estate investor should be beneficial in helping you become more knowledgeable and competent in sidestepping common pitfalls.

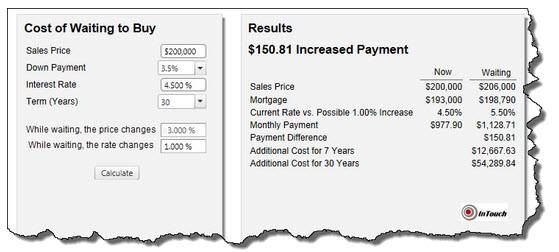

Home prices have gone up considerably in almost every market in the country in the past year and while inventories are beginning to grow, prices are expected to continue to rise. Mortgage rates jumped 1% from the beginning of May to now. They could easily reach 5% by the end of the year and continue to rise in 2014.

Home prices have gone up considerably in almost every market in the country in the past year and while inventories are beginning to grow, prices are expected to continue to rise. Mortgage rates jumped 1% from the beginning of May to now. They could easily reach 5% by the end of the year and continue to rise in 2014.