Real Estate Information

Montgomery Real Estate Blog

The Hat Team

Blog

Displaying blog entries 1781-1790 of 1998

Montgomery Real Estate For Sale: 1852 Graham Street

Learn more about 1852 Graham Street and other Montgomery real estate by visiting HatTeam.com.

Montgomery Homes For Sale: 2632 Boultier Ave

MLS# 261089

Montgomery Homes For Sale: 1415 Wedgewood Drive

MLS# 262367

Montgomery Homes For Sale: 2031 Fernway Drive

Montgomery Homes For Sale:

MLS # 262371

If you love to entertain, you'll love this Mediterranean style home in Mcgehee Estates. The home's focal point is a central salt-water pool and cabana area providing several private outdoor "rooms for intimate gatherings or lavish parties for many. Unique style and layout make this home perfect for those who like out-of-the-ordinary. Master suite has potential to be exquisite with a little updating. Come take a look, and discover all the unique features and qualities this hidden treasure has to offer.

If you love to entertain, you'll love this Mediterranean style home in Mcgehee Estates. The home's focal point is a central salt-water pool and cabana area providing several private outdoor "rooms for intimate gatherings or lavish parties for many. Unique style and layout make this home perfect for those who like out-of-the-ordinary. Master suite has potential to be exquisite with a little updating. Come take a look, and discover all the unique features and qualities this hidden treasure has to offer.Ins And Outs Of Montgomery Short Sales

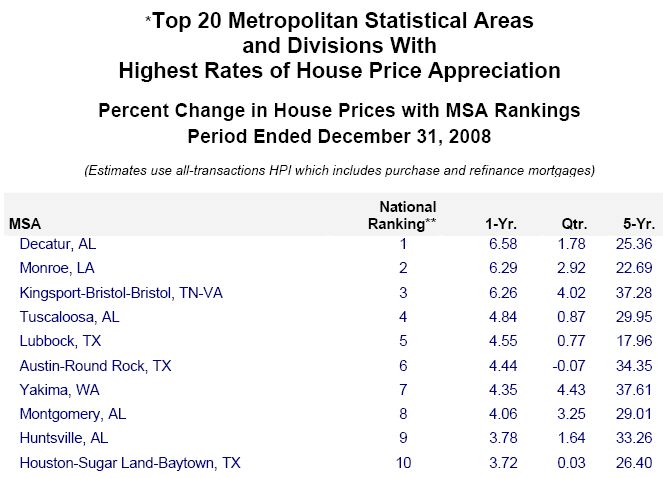

Montgomery Real Estate Appreciation Ranks 8th

The Office of Federal Housing Enterprise Oversight has ranked Montgomery among the top ten cities for median home price appreciation when compare to 300 metropolitan areas in a fourth-quarter home price appreciation index. Montgomery ranks 8th with 4.06 percent appreciation for the year, 3.25 percent appreciation for the quarter and 29.01 percent appreciation over the past 5 years.

Montgomery real estate is definitely holding its own compared to other parts of the country. These statistics along with the $8000 first time home buyer tax credit, an abundance of inventory and record low interest rates, make NOW a great time to buy Montgomery real estate. You can learn more at HatTeam.com.

Montgomery Real Estate Sales Statistics - January 2009

|

Midtown

Montgomery |

Pending

Sales |

Sold

Listings |

Average

Market Times |

Average

Sales Price |

|

Jan 2009

|

30

|

23

|

72

|

$57,026

|

|

Jan 2008

|

45

|

28

|

107

|

$226,345

|

Low Cost Energy Saving Tips For Montgomery Homeowners

Some easy low-cost and no-cost ways to save energy include:

-

Install a programmable thermostat to keep your house comfortably warm in the winter and comfortably cool in the summer.

-

Use compact fluorescent light bulbs with the ENERGY STAR® label.

-

Air dry dishes instead of using your dishwasher's drying cycle.

-

Turn off your computer and monitor when not in use.

-

Plug home electronics, such as TVs and DVD players, into power strips; turn the power strips off when the equipment is not in use (TVs and DVDs in standby mode still use several watts of power).

-

Lower the thermostat on your hot water heater to 120°F.

-

Take short showers instead of baths.

-

Wash only full loads of dishes and clothes.

-

Drive sensibly. Aggressive driving (speeding, rapid acceleration and braking) wastes gasoline.

-

Look for the ENERGY STAR label on home appliances and products. ENERGY STAR products meet strict efficiency guidelines set by the U.S. Department of Energy and the Environmental Protection Agency.

Should I Be Movin' On Up To A Larger Montgomery Home?

Displaying blog entries 1781-1790 of 1998