Wednesday, January 14, 2015

by The Hat Team

0% financing has induced car buyers into taking the plunge because it doesn’t cost anything to use someone else’s money. While mortgage rates are not at zero, they’re close enough that many buyers are applying similar logic.

Qualified mortgage interest is deductible on taxpayers' returns subject to the maximum acquisition debt of one million dollars. For the fortunate homeowners who have paid off their mortgage, their acquisition debt was reduced to zero and only the interest on a maximum home equity debt of $100,000 is deductible.

Qualified mortgage interest is deductible on taxpayers' returns subject to the maximum acquisition debt of one million dollars. For the fortunate homeowners who have paid off their mortgage, their acquisition debt was reduced to zero and only the interest on a maximum home equity debt of $100,000 is deductible.

If you have to pay interest, deductible interest is preferable because it reduces your actual cost.

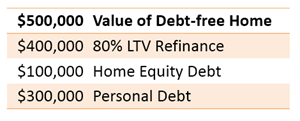

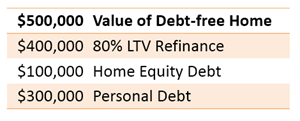

Consider the following example of a taxpayer with a $500,000 debt-free home. If they did an 80% cash-out refinance of $400,000, $100,000 would be considered home equity debt and the interest on that would be deductible on their income tax. The other $300,000 of debt is considered personal debt and the interest is not deductible.

However, because the rates are currently so low, the loss of deductibility of the interest doesn’t have as much impact as if the rates were higher. The key is to have a good purpose for the money that would offset the actual cost of the interest.

Paying off a higher rate debt such as credit cards, student loans, possibly, business debt could all have significantly higher interest rates. Refinancing a home and eliminating debts like these could be a big savings.

All lenders are not the same. Call for a recommendation of a trusted mortgage professional.

Information courtesy of Montgomery Real Estate Experts Sandra Nickel Hat Team!

.jpg)

.jpg)

Sellers

Sellers Start early to research and plan

Start early to research and plan

Qualified mortgage interest is deductible on taxpayers' returns subject to the maximum acquisition debt of one million dollars. For the fortunate homeowners who have paid off their mortgage, their acquisition debt was reduced to zero and only the interest on a maximum home equity debt of $100,000 is deductible.

Qualified mortgage interest is deductible on taxpayers' returns subject to the maximum acquisition debt of one million dollars. For the fortunate homeowners who have paid off their mortgage, their acquisition debt was reduced to zero and only the interest on a maximum home equity debt of $100,000 is deductible.