Real Estate Predictions For 2015

A new year has begun and it seems to me that time goes faster and faster each day. The economy is predicted to grow around 3% in 2015 and as you can guess that is good news for the real estate business! The real estate market holds a few more predictions for 2015…

Interest rates are still low compared to what they have been in years passed but Freddie Mac is predicting that interest rates will rise above the low 4% they had dipped to in 2014 to up to 5% by the end of 2015. Still these interest rates are extremely low so if you are in the market for a new house you should go ahead and plan on making a purchase sometime in the year of 2015.

Interest rates are still low compared to what they have been in years passed but Freddie Mac is predicting that interest rates will rise above the low 4% they had dipped to in 2014 to up to 5% by the end of 2015. Still these interest rates are extremely low so if you are in the market for a new house you should go ahead and plan on making a purchase sometime in the year of 2015. - Prices for houses by the end of 2015 are predicted to be a little higher than in years passed but not so high that they won’t still be affordable. Home appreciation will likely move to 4.5 percent instead of 9.3 percent as in 2014. It may be that home appreciation will drop to 3 percent by the end of 2015.

- If building a home is in your plans then you are apparently on target with a lot of other folks. The building of new homes is expected to rise 20 percent from 2014. If you don’t find the house that fits your every need this coming year on the market, it will be a great year to build it to your own specifications.

- Not as many folks will be refinancing in 2015. As a matter of fact refinances will drop to make up only about 23 percent of single family orientations this coming year. In 2014 refinances made up roughly more than half of single family orientations.

- It will be a bit easier to get a loan for your new home purchase in 2015 as some of the restrictions that were once placed on new home buyers will be eased. Funding sources will grow for new home buyers in 2015 as well.

As you can see there is a lot of good news for the real estate market in 2015. If you are considering buying a home, don’t wait another day longer…get on the phone and call a qualified Real Estate agent today to get you started in the right direction.

Information courtesy of Montgomery Realtors Sandra Nickel Hat Team!

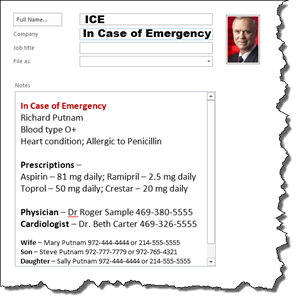

The concept is simple. Make a contact record in your address book with the name “ICE”, which stands for In Case of Emergency. In the note section of the record, you would list your name, blood type and medical conditions along with prescriptions and physicians. You’d also list the people and their phone numbers that can be contacted in case of an emergency.

The concept is simple. Make a contact record in your address book with the name “ICE”, which stands for In Case of Emergency. In the note section of the record, you would list your name, blood type and medical conditions along with prescriptions and physicians. You’d also list the people and their phone numbers that can be contacted in case of an emergency.

Decorate your home like you have never decorated it before to make it stand out above all the other homes that are for sale during the holiday season. You may not feel like doing this because you are most likely ready to move out and get on with your life, but if you take the time to make your home look beautiful for the holidays, it is most likely going to get the attention of several buyers that might not otherwise take a second look at your home. Be sure to have a few showings during the evenings if your Realtor will agree so that you can show off your awesome light display.

Decorate your home like you have never decorated it before to make it stand out above all the other homes that are for sale during the holiday season. You may not feel like doing this because you are most likely ready to move out and get on with your life, but if you take the time to make your home look beautiful for the holidays, it is most likely going to get the attention of several buyers that might not otherwise take a second look at your home. Be sure to have a few showings during the evenings if your Realtor will agree so that you can show off your awesome light display. In some cases, you might only be able to name one or two of your neighbors who would step up to that level of service. Wouldn’t it be nice if more people on your street would be happy to make that offer?

In some cases, you might only be able to name one or two of your neighbors who would step up to that level of service. Wouldn’t it be nice if more people on your street would be happy to make that offer? before the temperatures get down too low to get your home ready for the cold. In this blog we are going to give you three ways to

before the temperatures get down too low to get your home ready for the cold. In this blog we are going to give you three ways to